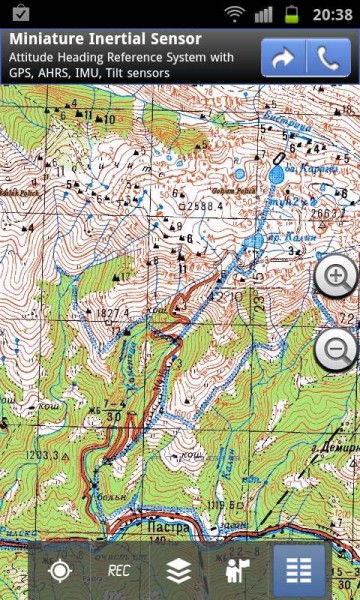

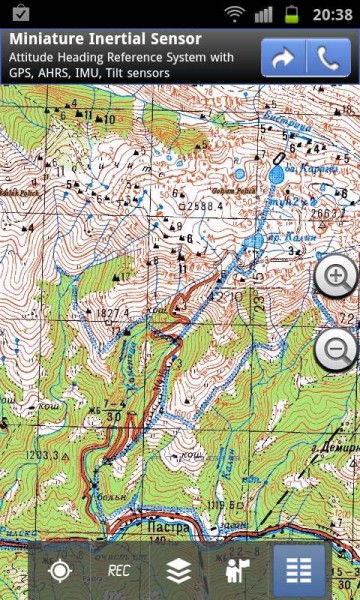

Offroad Navigation App for android with Russian topographic military maps at scales from 1:100.000 to 1:500.000. For many countries in Europe, Africa and Asia these maps belong still to the best available topomaps.

Usually I’m preparing custom maps using Genshtab’s Soviet military maps and other apps like Androzic or OziExplorer for android, but guys, this is an incredible app. And using bulk downloader of map tiles – there is no other app like this.

Available map layers:

• Topomaps worldwide (100K-500K worldwide seamless coverage)

• Openstreetmap (OSM Mapnik, Osmarender and Cloudemade Cyclemap)

• Google Maps (Satellite-, road- and terrainmap)

Main features for Outdoor-Navigation:

• Create and edit Waypoints

• GoTo-Waypoint-Navigation (linear distance)

• Trackrecording (with speed and elevation profile)

• Tripmaster for distance, average speed, bearing, etc.

• GPX-Import / Export, KML-Export

• Search (placenames, POIs, streets)

• Customizable datafiels in Map View and Tripmaster (e.g. Speed, Distance, Compass, ..)

• Bulk-download of map tiles for offline usage (NOT in free version)

• Waypoint-/Track-Sharing (via eMail, Facebook, ..)

Soviet Military Maps is the perfect moving map app for offroad trips, adventure travels and expeditions. You are planning cross country trips to Sahara by 4×4/motorbike or a trekking tour to the Himalayas ? With the Russian topos you have always a great alternative to other map sources. Beneath the good topography the maps include many small trails and unpaved roads that are missing in other map sets.

Attention: The Soviet Military Maps were created mainly in the 80ies and are less interesting for industrialized countries. Outside Africa and Asia you’ll find the OSM/Google map layers more useful.

Please note: This app does not provide “Turn-by-Turn” – navigation nor route calculation.

Country coverage:

Scale 1:100.000 and 1:200.000 :

Europe, Afghanistan, Georgia, Japan, Kyrgyzstan, Morocco, Pakistan, Russia, Tajikistan, Uzbekistan

Scale 1:200.000 :

Afghanistan, Egypt, Algeria, Angola, Argentina, Armenia, Azerbaijan, Bahrain, Bangladesh, Belarus, Benin, Bhutan, Bolivia, Botswana, British Virgin Islands, Bulgaria, Burkina Faso, Burma, Cambodia, Cameroon, Central African Republic, Chad, Chile, China, Comoros, Ivory Coast, Cuba, Cyprus, Czech Republic, DR Congo (part), Djibouti, Eritrea, Estonia, Ethiopia, Falkland Islands, Finland, Gambia, Georgia, Ghana, Guinea, Guinea-Bissau, Iceland, India, Indonesia, Iran, Iraq, Israel, Jamaica, Jordan, Kazakhstan, Kenya (part), Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Lesotho, Liberia, Libya, Lithuania, Madagascar, Malawi, Malaysia, Mali, Mauritania, Moldova, Mongolia , Morocco, Mozambique, Namibia, Nepal, Niger, Nigeria, North Korea, Oman, Pakistan, Philippines, Qatar, Romania, Russia, Saudi Arabia, Senegal, Sierra Leone, Singapore, Slovakia, Somalia, South Africa, South Korea, Spain, Sri Lanka , Sudan, Svalbard, Swaziland, Sweden, Syria, Taiwan, Tajikistan, Tanzania (part), Thailand, The Gambia, Togo, Tunisia, Turkey, Turkmenistan, Ukraine, United Arab Emirates, Uzbekistan, Vietnam, Western Sahara, Yemen, Zambia, Zimbabwe

Scale 1:250.000 (Local maps from USGS, Geoscience Australia, CTIO ):

USA, Canada, Australia

Scale 1:500.000:

All other countries

Map legend and cyrillic alphabet:

http://www.topomapper.com/PDF/Soviet_Military_Maps_Documentation.pdf

Soviet Military Maps Android Market Free

Soviet Military Maps Android Market