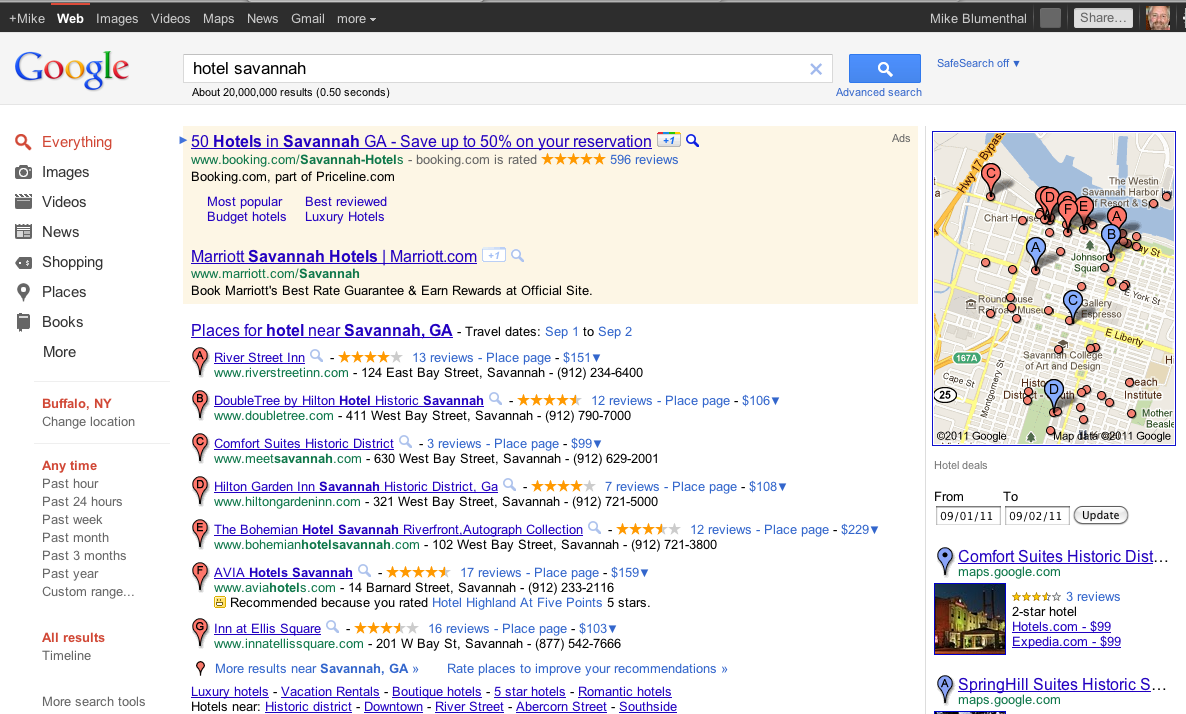

Last week amidst the noise of changes in the Place’s layout, Google noted that they would be “Integrating some of the great information that’s been buried on Place pages into your web search experience across all Google platforms“. While Google doesn’t talk much about their thinking or the future, when they do, I have learned that you can take them at their word. They have in fact quickly started this process of projecting data from within Places more broadly, resulting in its higher visibility and an increased liklihood of being seen. They are putting more photos from Places into the branded One Box in the main search results and have started showing coupons from Places in their mobile Shopper app (OMG will coupons finally make their Phoenix like re-appearance after 4 moribund years?) .

The Google Hotel Finder experiment is yet another example that they are taking buried information from Places and Maps and experimenting with making it more visible. In the process they are making search results more engaging and interactive, demonstrating their move from being strictly a search results provider to using search to generate useful content that will attract and retain users. More users, a longer time on the site and a fresh way of looking at previously buried content will obviously also provide additional ways to sell more ads.

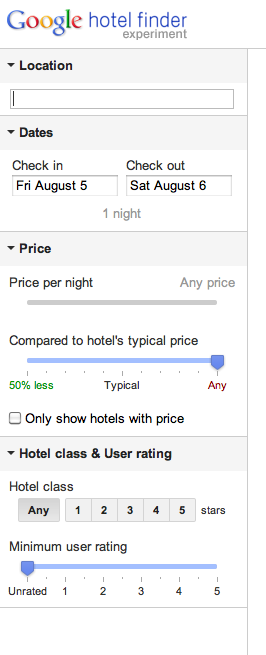

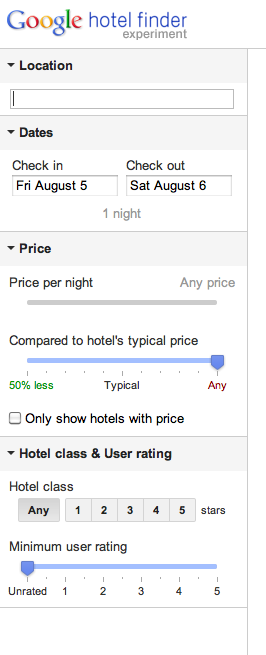

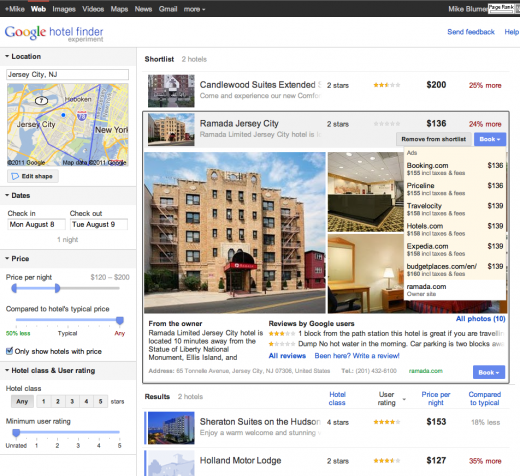

Rather than the standard Google approach of the single search box and their educated guess as to what searchers want, the Hotel Finder interface, in very un-Google like fashion, provides a more faceted approach to finding exactly the information that a user is looking for. The choices allow for a great deal of granularity of pricing, relative pricing and quality.

Rather than the standard Google approach of the single search box and their educated guess as to what searchers want, the Hotel Finder interface, in very un-Google like fashion, provides a more faceted approach to finding exactly the information that a user is looking for. The choices allow for a great deal of granularity of pricing, relative pricing and quality.

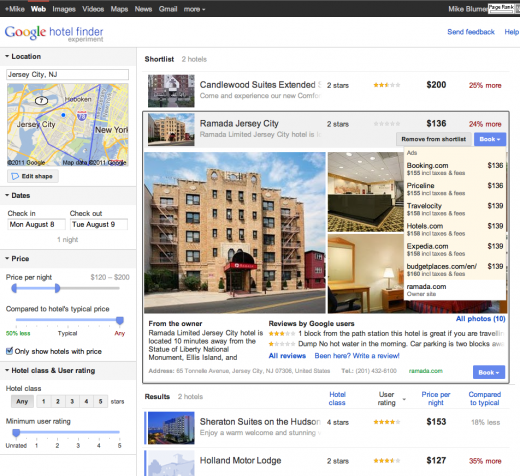

If the broad, single field geo search does not return the appropriate geography, the user can drill into the map and literally outline the appropriate neighborhoods themselves via interactive, draggable boundary lines. The map view provides a heat mapped representation of the most popular areas.

The interface allows a user to build repeated queries with slightly different parameters and save the results into a “short list” of choices. Thus if you wanted to compare hotels in two or three totally distinct non-adjacent neighborhoods, say the Upper West Side, Tribecca and Park Slope, a user could create a custom view of hotels from which to choose and then share the view via URL with another.

More details about a given hotel, a Places view if you will, with a very attractive layout can be seen by clicking on the hotel of choice. The user is presented with an array of photos, review summaries and the owner description. It seems to reflect a new, thoughtful design sensibility on the part of Google.

Of course, it is not just a view of content but offers the option of booking the hotel via their still secretive hotel booking tool. All in all it is in impressive experiment with a subtle transactional nature. It is both more polished and definitely better looking than most Google experiments. It is very slick and offers an interface that could be easily adapted to restaurants, bars, florists and hair salons (to name a few) and of course to mobile.

If this experiment is any indication, the future of search is local search and it is an interesting one. With the acquisition of ITA and Google’s obvious and long standing desire to move into the hotel booking market, this experiment shows how Google is thinking about both the data and the market. Many have explained the recent changes as a reactive response to anti-trust complaints. It could equally be explained as a proactive measure that would allow Google to be in a more competitive position going forward as they compete more directly against the likes of TripAdvisor and Yelp.

The Google Hotel Finder experiment is not just search as we have come to know it but search as interactive content that has the ability to achieve serendipity in both interaction and results. And of course in a way that makes the sale.

Finally with the release of Hotpot last year and Google’s subsequent success in garnering ratings and reviews things started to change on the review front. Research was indicating that Google was making strides and soon Google stepped out and into the “we have lots of reviews game”. Yelp of course rose to the bait and insisted on engaging in the my review corpus is bigger than yours type posturing.

Finally with the release of Hotpot last year and Google’s subsequent success in garnering ratings and reviews things started to change on the review front. Research was indicating that Google was making strides and soon Google stepped out and into the “we have lots of reviews game”. Yelp of course rose to the bait and insisted on engaging in the my review corpus is bigger than yours type posturing.